Understanding the Loan Estimate: A Comprehensive Guide for Borrowers

Related Articles: Understanding the Loan Estimate: A Comprehensive Guide for Borrowers

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Loan Estimate: A Comprehensive Guide for Borrowers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Loan Estimate: A Comprehensive Guide for Borrowers

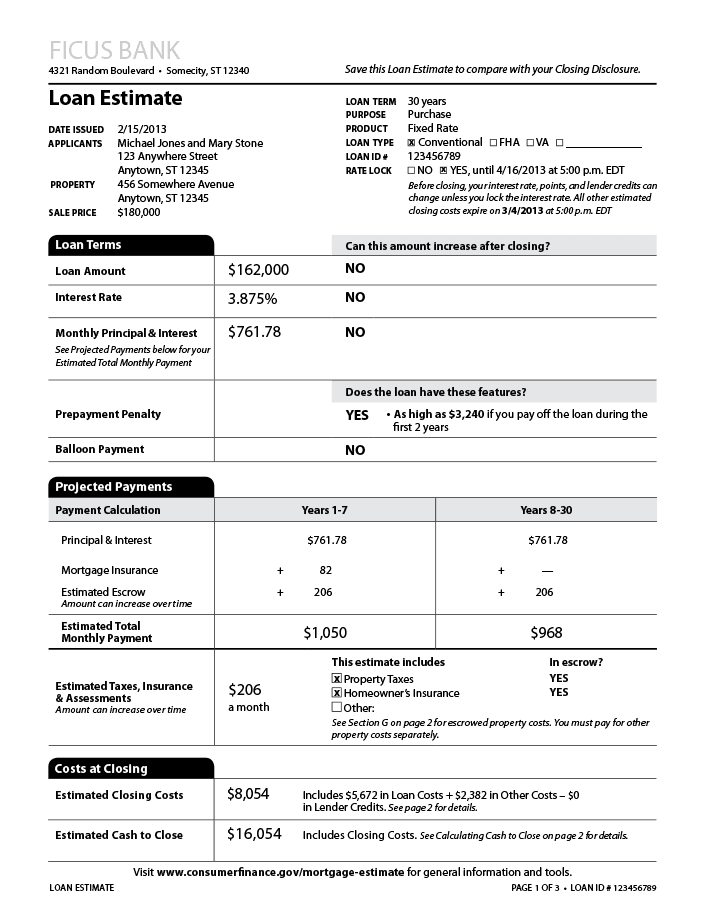

In the complex world of mortgage lending, navigating the process can feel overwhelming. One crucial document that empowers borrowers with clarity and transparency is the Loan Estimate. This document, mandated by the Real Estate Settlement Procedures Act (RESPA), provides a detailed breakdown of the estimated costs associated with a mortgage loan. Understanding the Loan Estimate is essential for borrowers to make informed decisions about their financing.

What is a Loan Estimate?

The Loan Estimate is a standardized form that lenders are required to provide to borrowers within three business days of receiving a complete loan application. It serves as a snapshot of the potential loan terms and costs, including:

- Loan Details: Loan amount, interest rate, loan type (e.g., fixed-rate, adjustable-rate), and loan term.

- Estimated Closing Costs: Fees associated with the mortgage transaction, such as origination fees, appraisal fees, title insurance, and recording fees.

- Estimated Monthly Payments: Projected monthly principal and interest payments, including estimated property taxes and homeowner’s insurance.

- Loan Costs: Detailed breakdown of fees, including whether they are paid at closing or over the life of the loan.

- Important Disclosures: Information regarding prepayment penalties, escrow accounts, and the lender’s right to change the loan terms.

Benefits of the Loan Estimate

The Loan Estimate plays a crucial role in empowering borrowers by providing them with the necessary information to make informed decisions. Its benefits include:

- Transparency: By providing a clear and concise breakdown of estimated costs, the Loan Estimate eliminates hidden fees and surprises during the closing process.

- Comparison Shopping: Borrowers can use the Loan Estimate to compare loan offers from different lenders, allowing them to choose the most advantageous option.

- Financial Planning: The estimated monthly payments and closing costs provide borrowers with a realistic picture of their financial obligations, facilitating effective budgeting and financial planning.

- Protection Against Unfair Practices: The standardized format of the Loan Estimate helps protect borrowers from predatory lending practices and ensures they are not misled about the true cost of their mortgage.

Key Components of the Loan Estimate

The Loan Estimate is divided into several sections, each providing specific information relevant to the mortgage transaction. Key components include:

- Loan Terms: This section details the loan amount, interest rate, loan type, and loan term.

- Closing Costs: This section lists all estimated fees associated with the mortgage transaction, including lender fees, third-party fees, and government recording fees.

- Estimated Monthly Payments: This section provides a breakdown of the projected monthly principal and interest payments, including estimated property taxes and homeowner’s insurance.

- Loan Costs: This section outlines the fees associated with the mortgage loan, including whether they are paid at closing or over the life of the loan.

- Important Disclosures: This section includes essential information regarding prepayment penalties, escrow accounts, and the lender’s right to change the loan terms.

Understanding the Loan Estimate Calendar

While the Loan Estimate provides a snapshot of the potential loan terms and costs, it is important to remember that these estimates can change. The Loan Estimate Calendar, provided alongside the document, outlines the key deadlines and milestones associated with the mortgage process. Understanding this calendar is crucial for borrowers to stay informed and manage their expectations.

- Three-Day Waiting Period: The Loan Estimate must be provided to borrowers within three business days of receiving a complete loan application. Borrowers have three days to review the document before proceeding.

- Disclosure of Changes: Lenders are required to disclose any changes to the Loan Estimate within seven business days of receiving the borrower’s acceptance of the loan terms.

- Closing Disclosure: The Closing Disclosure, a final document that details the actual loan terms and costs, must be provided to borrowers at least three business days before closing.

FAQs about the Loan Estimate

Q: What if the Loan Estimate changes after I receive it?

A: Lenders are required to disclose any changes to the Loan Estimate within seven business days of receiving the borrower’s acceptance of the loan terms. If the changes are significant, borrowers have the right to reconsider their loan offer.

Q: How can I compare Loan Estimates from different lenders?

A: The standardized format of the Loan Estimate makes it easy to compare loan offers from different lenders. Focus on the interest rate, loan terms, and estimated closing costs to determine the most advantageous option.

Q: What happens if I don’t understand something on the Loan Estimate?

A: Don’t hesitate to ask your lender for clarification. It is their responsibility to explain the document thoroughly and answer any questions you may have.

Q: Can I negotiate the fees listed on the Loan Estimate?

A: While some fees may be non-negotiable, others can be negotiated. Discuss your concerns with your lender and explore potential options for reducing costs.

Tips for Using the Loan Estimate Effectively

- Review the Loan Estimate carefully: Take the time to read through the document thoroughly and understand all the terms and conditions.

- Compare Loan Estimates from different lenders: Shop around and compare offers to find the most favorable terms.

- Ask questions: Don’t hesitate to ask your lender for clarification on any aspect of the Loan Estimate.

- Understand the Loan Estimate Calendar: Be aware of the key deadlines and milestones outlined in the calendar to stay informed and manage expectations.

- Negotiate fees if possible: Discuss any concerns you have about the fees listed on the Loan Estimate and explore potential options for reducing costs.

Conclusion

The Loan Estimate is an essential document that empowers borrowers with transparency and control over their mortgage financing. By understanding the document’s key components and utilizing the Loan Estimate Calendar effectively, borrowers can make informed decisions, negotiate favorable terms, and ensure a smooth and successful mortgage transaction.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Loan Estimate: A Comprehensive Guide for Borrowers. We hope you find this article informative and beneficial. See you in our next article!