Navigating the Fiscal Year 2025: A Comprehensive Guide

Related Articles: Navigating the Fiscal Year 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Fiscal Year 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Fiscal Year 2025: A Comprehensive Guide

- 2 Introduction

- 3 Navigating the Fiscal Year 2025: A Comprehensive Guide

- 3.1 Understanding the Fiscal Year

- 3.2 FY25: A Key Milestone for Organizations

- 3.3 Key Dates in FY25: A Timeline for Effective Planning

- 3.4 Navigating Challenges in FY25: A Proactive Approach

- 3.5 FAQs: Addressing Common Questions about FY25

- 3.6 Tips for Success in FY25: A Practical Guide

- 3.7 Conclusion: Embracing the Opportunities of FY25

- 4 Closure

Navigating the Fiscal Year 2025: A Comprehensive Guide

The fiscal year, a period used for accounting and budgeting purposes, is a crucial element in the operations of businesses, governments, and various organizations. Understanding the nuances of the fiscal year, particularly the upcoming Fiscal Year 2025 (FY25), is essential for effective planning, forecasting, and achieving organizational goals. This article provides a comprehensive guide to FY25, exploring its significance, key dates, and practical implications for various stakeholders.

Understanding the Fiscal Year

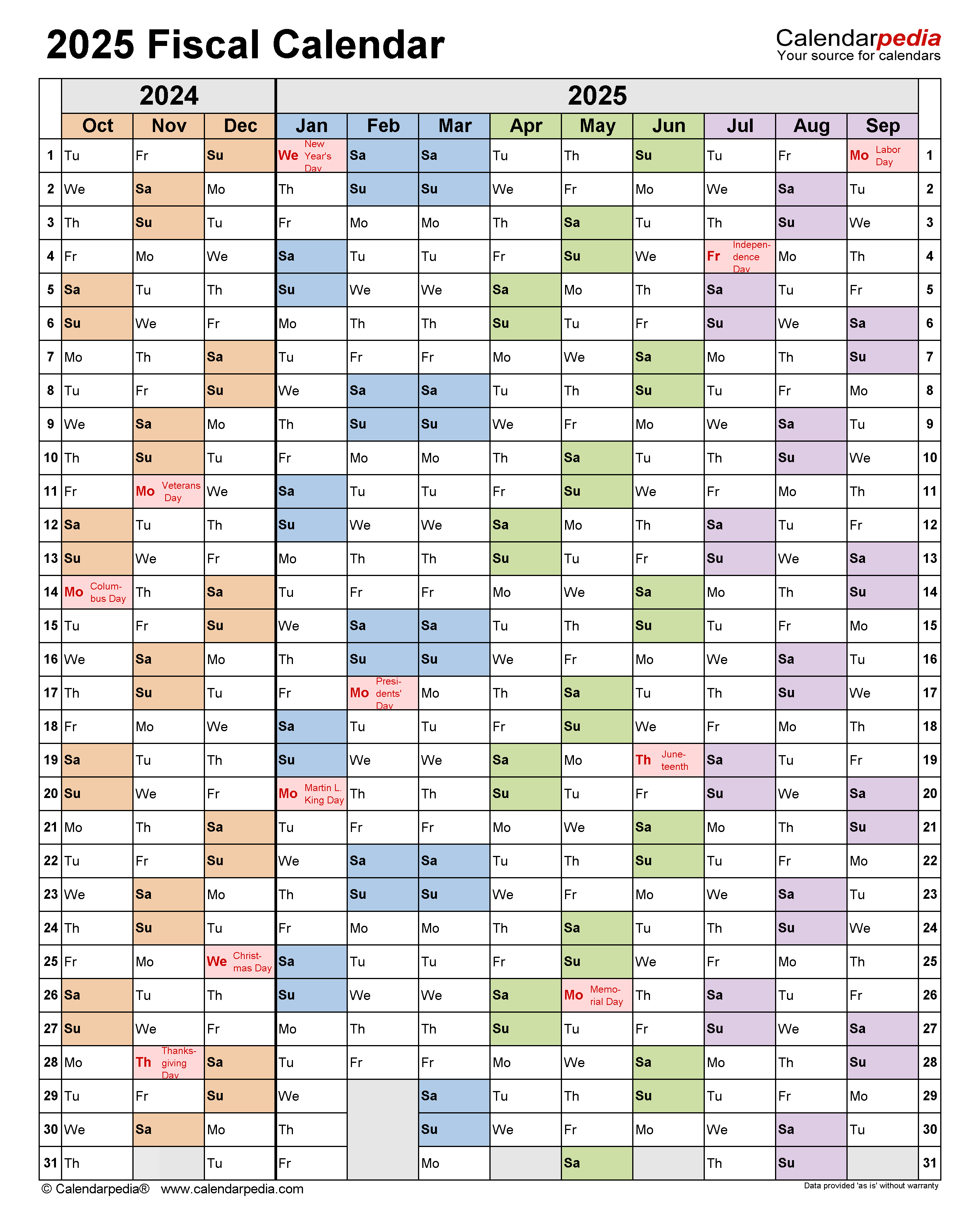

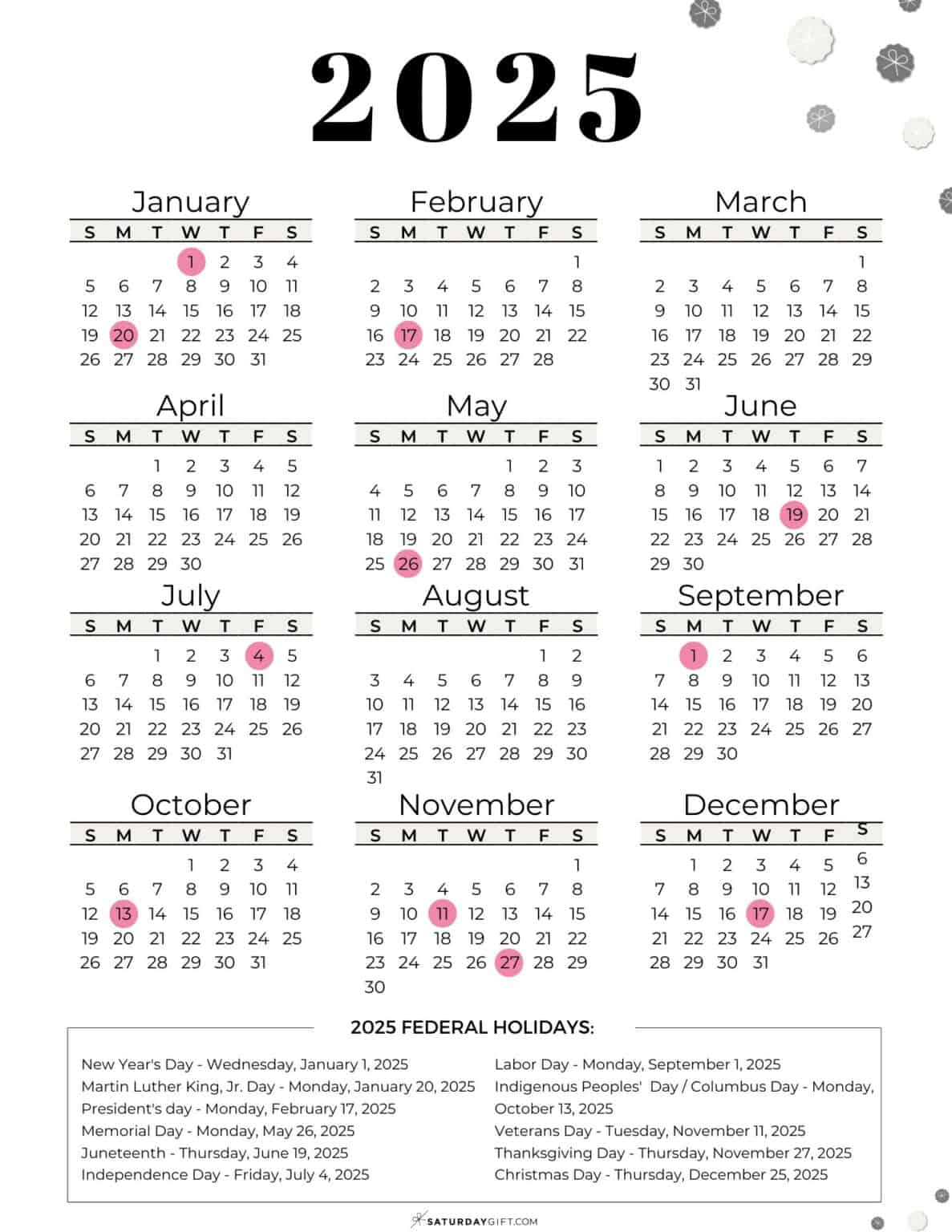

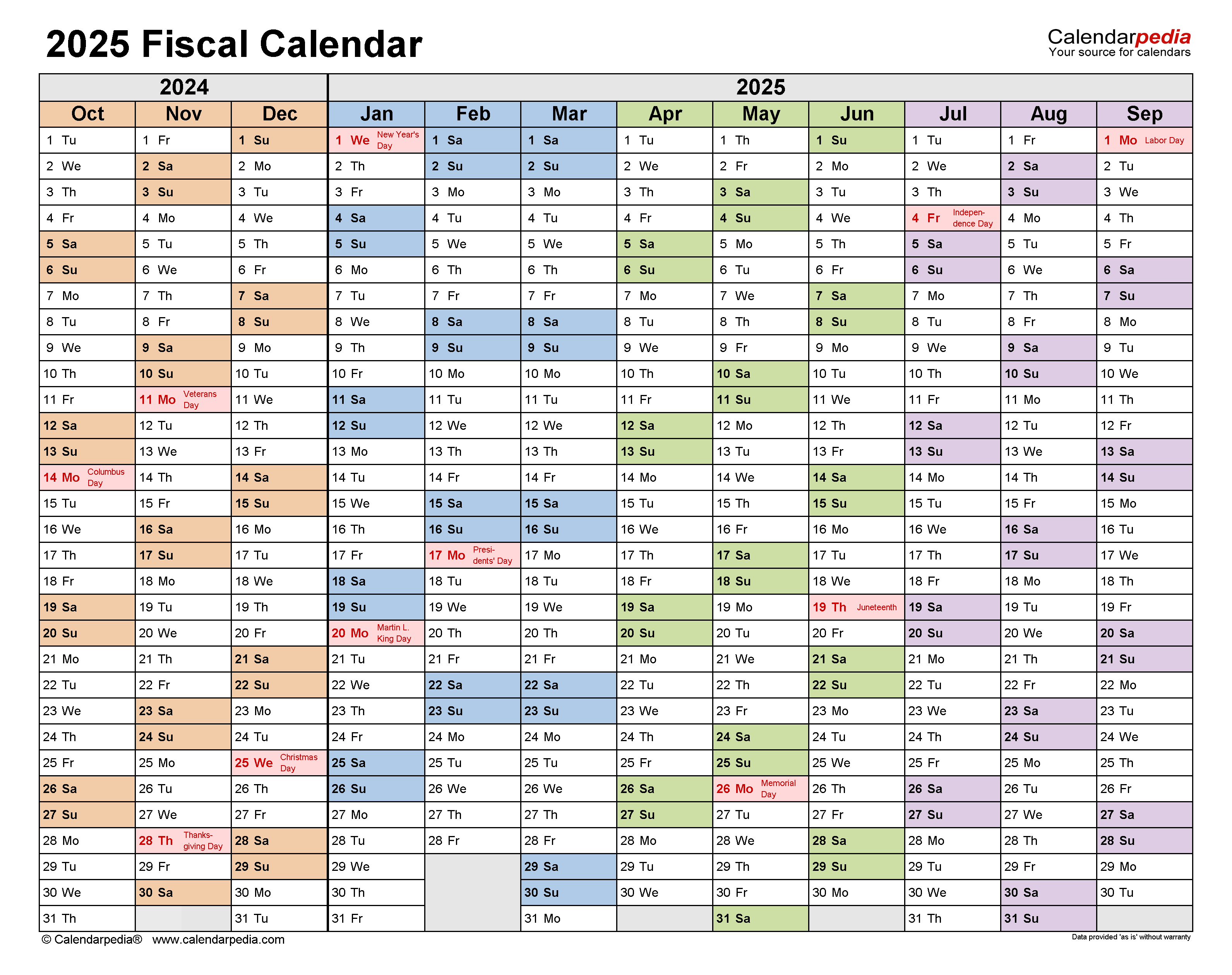

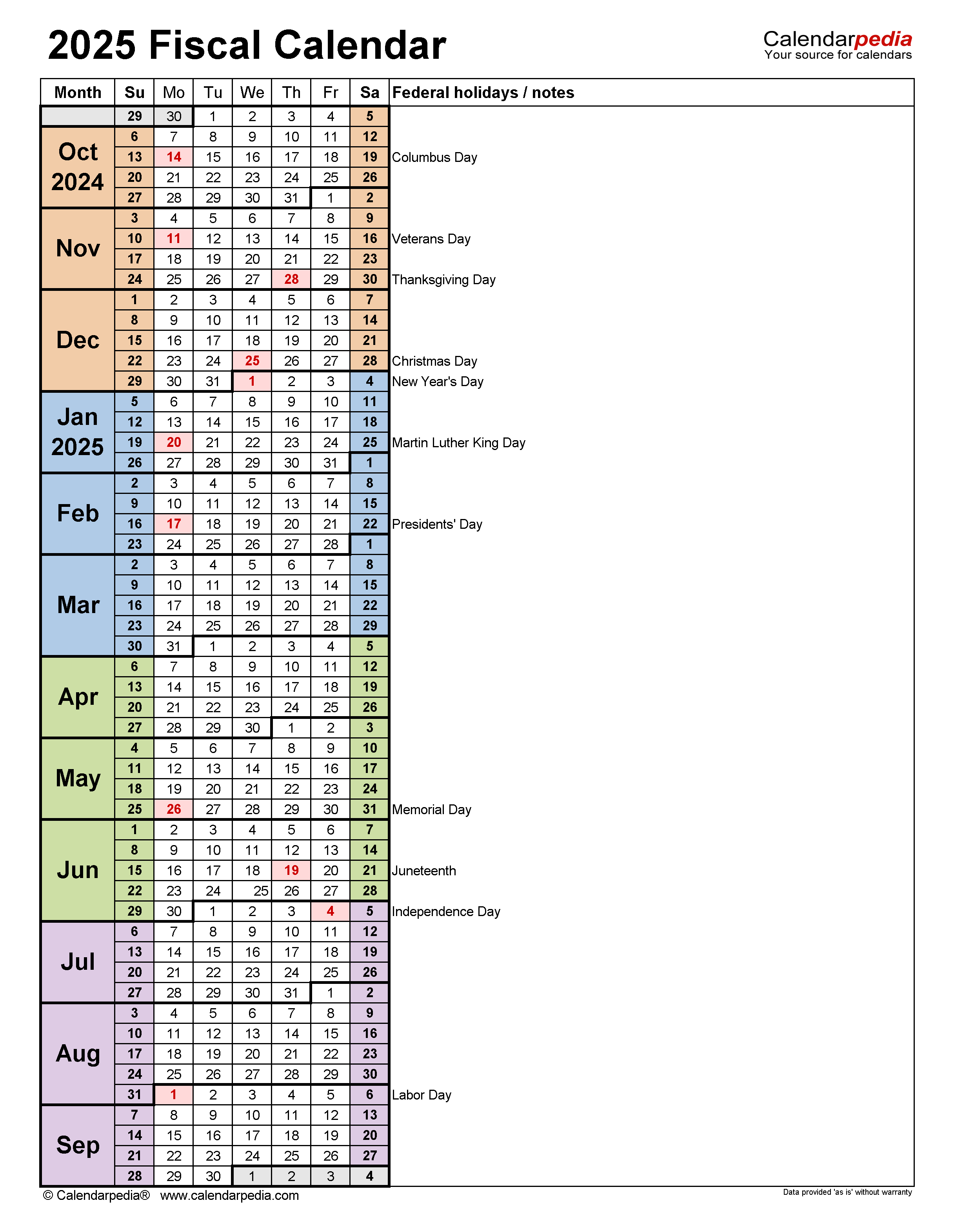

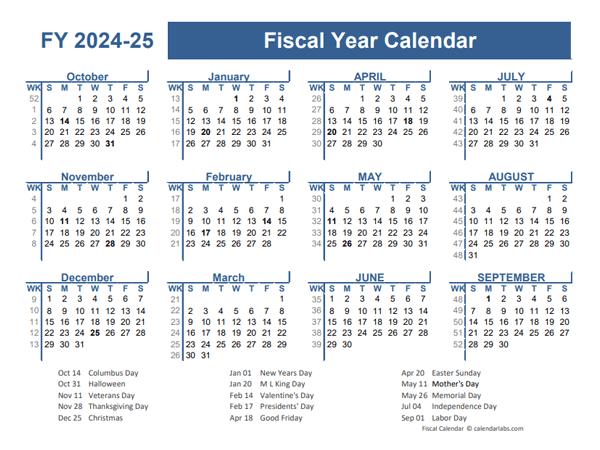

The fiscal year is distinct from the calendar year, which runs from January 1st to December 31st. While the calendar year is universally recognized, the fiscal year varies depending on the organization or jurisdiction. Some entities, like the United States federal government, operate on a fiscal year that begins on October 1st and ends on September 30th of the following year. Others, like the United Kingdom, utilize a fiscal year that starts on April 1st and concludes on March 31st.

The fiscal year structure allows organizations to:

- Align financial reporting with specific operational cycles: For example, a retail company might choose a fiscal year that aligns with its peak sales season.

- Facilitate budget planning and control: By defining a clear financial period, organizations can effectively allocate resources and monitor spending against predetermined targets.

- Streamline tax reporting and compliance: The fiscal year structure simplifies tax calculations and reporting by providing a consistent timeframe for revenue and expense tracking.

FY25: A Key Milestone for Organizations

The upcoming FY25 holds significant importance for various stakeholders. It represents a new cycle for financial planning, strategic decision-making, and operational execution. Businesses will be focusing on setting ambitious goals, allocating resources strategically, and navigating potential economic challenges. Governments will be developing budgets, implementing policies, and addressing critical societal issues. Non-profit organizations will be engaging in fundraising, program planning, and service delivery.

Understanding the key dates and milestones within FY25 is crucial for all stakeholders to effectively plan and manage their activities. These dates provide a framework for aligning operations, reporting, and decision-making.

Key Dates in FY25: A Timeline for Effective Planning

While the specific start and end dates of FY25 may vary depending on the organization or jurisdiction, a general timeline can be established. This timeline provides a framework for planning key activities and milestones throughout the year.

Early FY25:

- Budget Planning and Approval: Organizations begin the process of developing and finalizing their budgets for the upcoming fiscal year. This involves analyzing historical data, forecasting future trends, and allocating resources across various departments and initiatives.

- Strategic Planning and Goal Setting: Organizations revisit their long-term strategic plans and set specific, measurable, achievable, relevant, and time-bound (SMART) goals for FY25. These goals serve as guiding principles for operational activities and resource allocation.

- Performance Reviews and Assessment: Organizations conduct performance reviews of their previous fiscal year to identify areas of strength and weakness. This analysis helps inform future strategies and improve operational efficiency.

Mid-FY25:

- Mid-Year Budget Reviews: Organizations conduct mid-year budget reviews to assess progress against planned targets and adjust spending as needed. This ensures that resources are allocated effectively and that the organization remains on track to achieve its financial goals.

- Performance Monitoring and Reporting: Organizations regularly monitor their performance against key metrics and generate reports to track progress towards achieving their goals. These reports provide valuable insights for decision-making and course correction.

- Operational Optimization: Organizations focus on improving operational efficiency and effectiveness by streamlining processes, optimizing resource utilization, and implementing best practices.

Late FY25:

- Financial Reporting and Auditing: Organizations prepare and finalize their financial statements for the fiscal year. These statements provide a comprehensive overview of the organization’s financial performance and position.

- Tax Filing and Compliance: Organizations comply with tax regulations and file their tax returns based on their financial performance during the fiscal year.

- Year-End Planning and Forecasting: Organizations begin planning for the upcoming fiscal year by analyzing current trends, anticipating future challenges, and developing strategies for growth and sustainability.

Navigating Challenges in FY25: A Proactive Approach

While FY25 presents opportunities for growth and progress, it also presents challenges that organizations need to proactively address. These challenges can include:

- Economic Volatility: Global economic conditions can impact business operations, consumer spending, and investment decisions. Organizations need to remain agile and adaptable to navigate potential economic downturns or fluctuations.

- Inflation and Rising Costs: Increased inflation can erode purchasing power, drive up input costs, and impact profitability. Organizations need to implement cost-saving measures, explore alternative suppliers, and adjust pricing strategies to mitigate the impact of inflation.

- Supply Chain Disruptions: Global supply chain disruptions continue to pose challenges for businesses, affecting the availability of raw materials, components, and finished goods. Organizations need to diversify suppliers, build strategic inventory, and explore alternative sourcing options to minimize disruptions.

- Talent Acquisition and Retention: The competition for skilled talent remains fierce, making it challenging for organizations to attract and retain qualified employees. Organizations need to offer competitive compensation and benefits packages, foster a positive work environment, and invest in employee development to attract and retain top talent.

- Technological Advancements: Rapid technological advancements require organizations to adapt and invest in new technologies to remain competitive. This includes adopting new software, automating processes, and investing in digital transformation initiatives.

FAQs: Addressing Common Questions about FY25

1. What are the key differences between the fiscal year and the calendar year?

The fiscal year is a financial period used for accounting and budgeting purposes, distinct from the calendar year. The fiscal year can begin on any date, depending on the organization or jurisdiction, while the calendar year always begins on January 1st.

2. How does the fiscal year impact businesses?

The fiscal year provides a framework for financial planning, budget allocation, performance monitoring, and tax reporting. Businesses align their operations and decision-making with the fiscal year to ensure effective financial management.

3. What are some key considerations for businesses entering FY25?

Businesses need to focus on strategic planning, budget allocation, operational efficiency, talent management, and navigating economic challenges. They should also adapt to technological advancements and embrace digital transformation.

4. How can governments prepare for FY25?

Governments need to develop comprehensive budgets, implement policies to address societal issues, and ensure effective resource allocation. They should also prioritize economic growth, job creation, and social welfare.

5. What are the key challenges facing non-profit organizations in FY25?

Non-profit organizations face challenges in fundraising, program planning, service delivery, and managing financial resources. They need to adapt to changing donor preferences, implement innovative fundraising strategies, and ensure program effectiveness.

Tips for Success in FY25: A Practical Guide

- Embrace data-driven decision-making: Utilize data analytics to gain insights into market trends, customer behavior, and operational performance. This data-driven approach supports informed decision-making and resource allocation.

- Prioritize innovation and agility: Invest in research and development, explore new technologies, and embrace agile methodologies to adapt to changing market conditions and customer needs.

- Foster a strong company culture: Create a positive and inclusive work environment that values employee contributions, promotes collaboration, and encourages continuous learning.

- Build strategic partnerships: Collaborate with other organizations, suppliers, and stakeholders to leverage resources, share knowledge, and expand market reach.

- Focus on sustainability and social responsibility: Integrate sustainability principles into business operations, prioritize ethical practices, and contribute to social causes to enhance brand reputation and attract investors.

Conclusion: Embracing the Opportunities of FY25

FY25 represents a crucial period for organizations to achieve their goals, navigate challenges, and embrace new opportunities. By understanding the significance of the fiscal year, aligning operations with key dates and milestones, and adopting a proactive approach to challenges, organizations can effectively plan, execute, and achieve success in the coming fiscal year. The insights provided in this article serve as a guide for navigating the complexities of FY25, empowering organizations to make informed decisions, optimize operations, and achieve sustainable growth.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Year 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!