Navigating the 2025 Payroll Calendar: A Comprehensive Guide for Efficient Financial Management

Related Articles: Navigating the 2025 Payroll Calendar: A Comprehensive Guide for Efficient Financial Management

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2025 Payroll Calendar: A Comprehensive Guide for Efficient Financial Management. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Payroll Calendar: A Comprehensive Guide for Efficient Financial Management

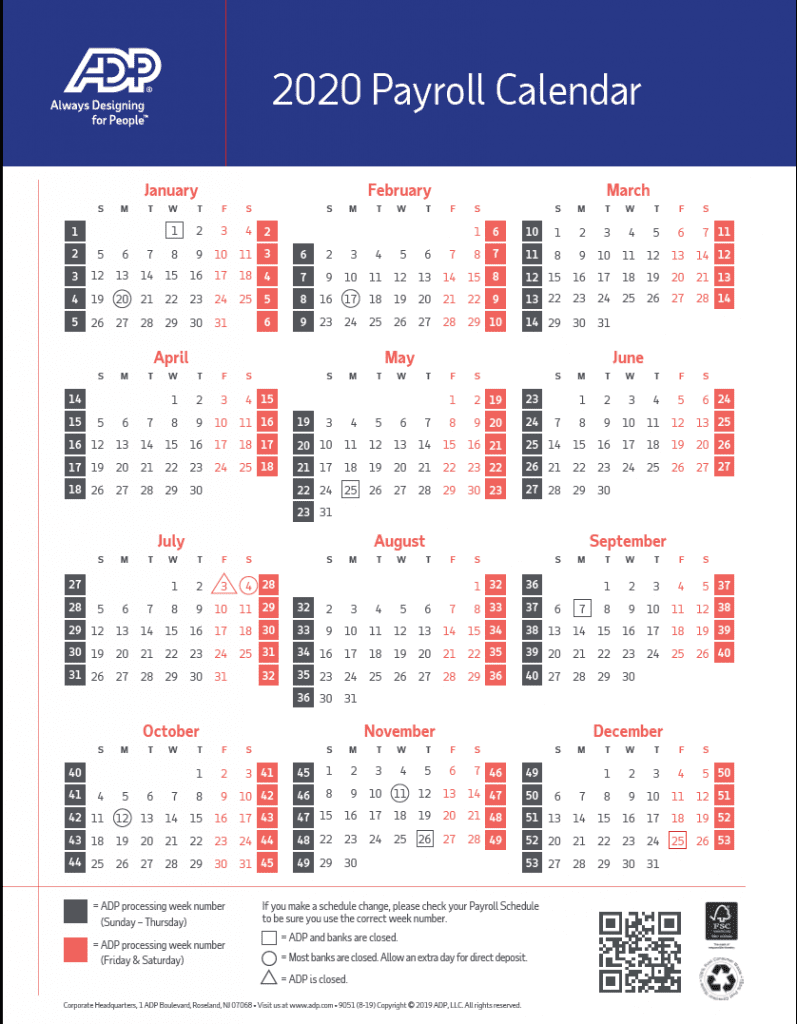

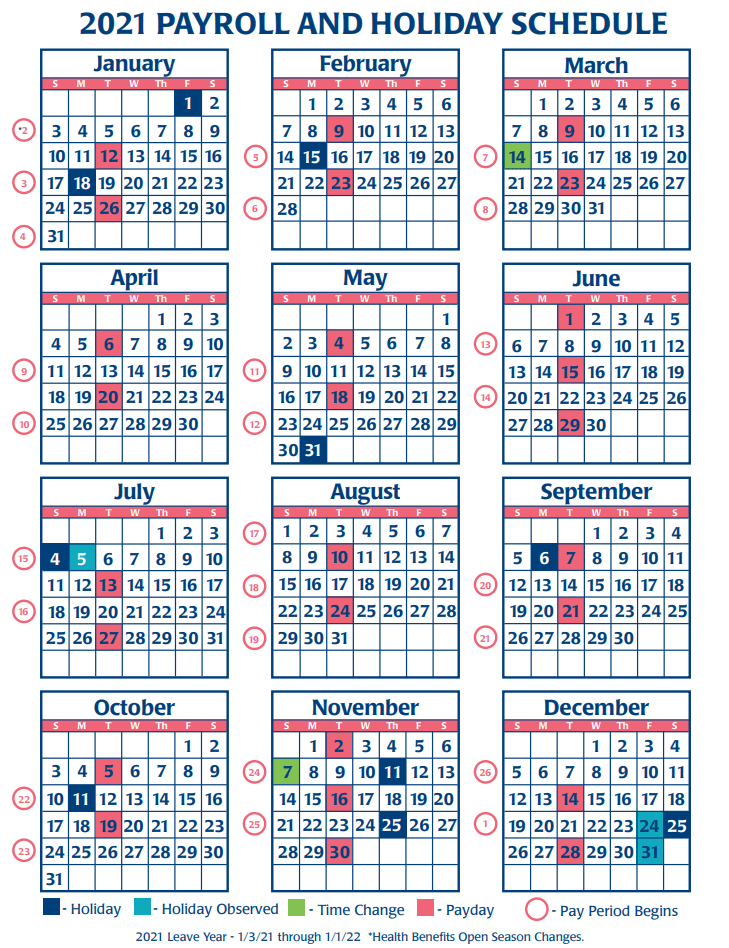

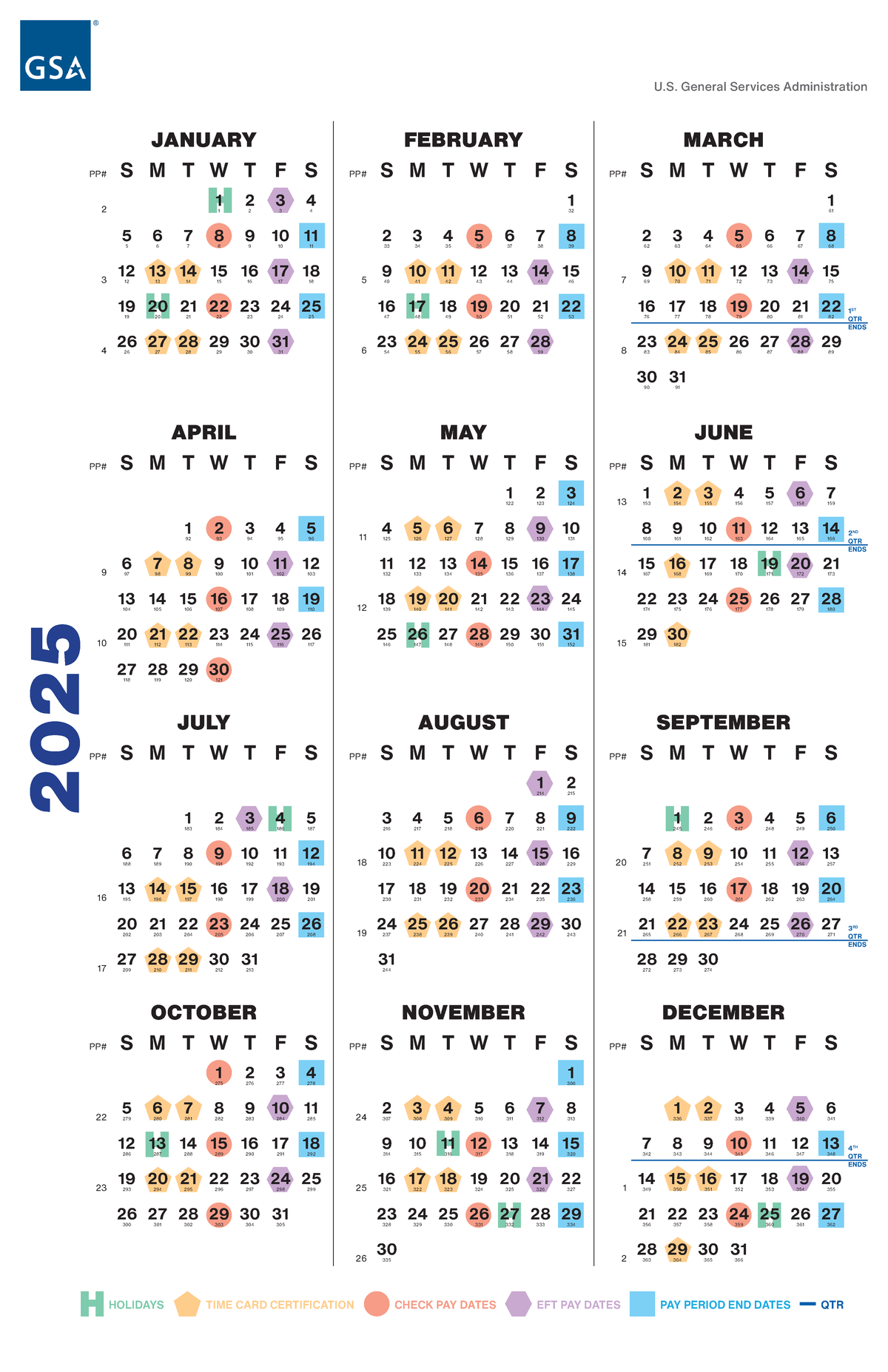

The 2025 payroll calendar serves as a crucial tool for businesses, organizations, and individuals alike, enabling them to plan and manage financial responsibilities effectively. This comprehensive guide provides a detailed overview of the 2025 payroll calendar, highlighting its importance, benefits, and practical applications.

Understanding the 2025 Payroll Calendar: A Foundation for Financial Stability

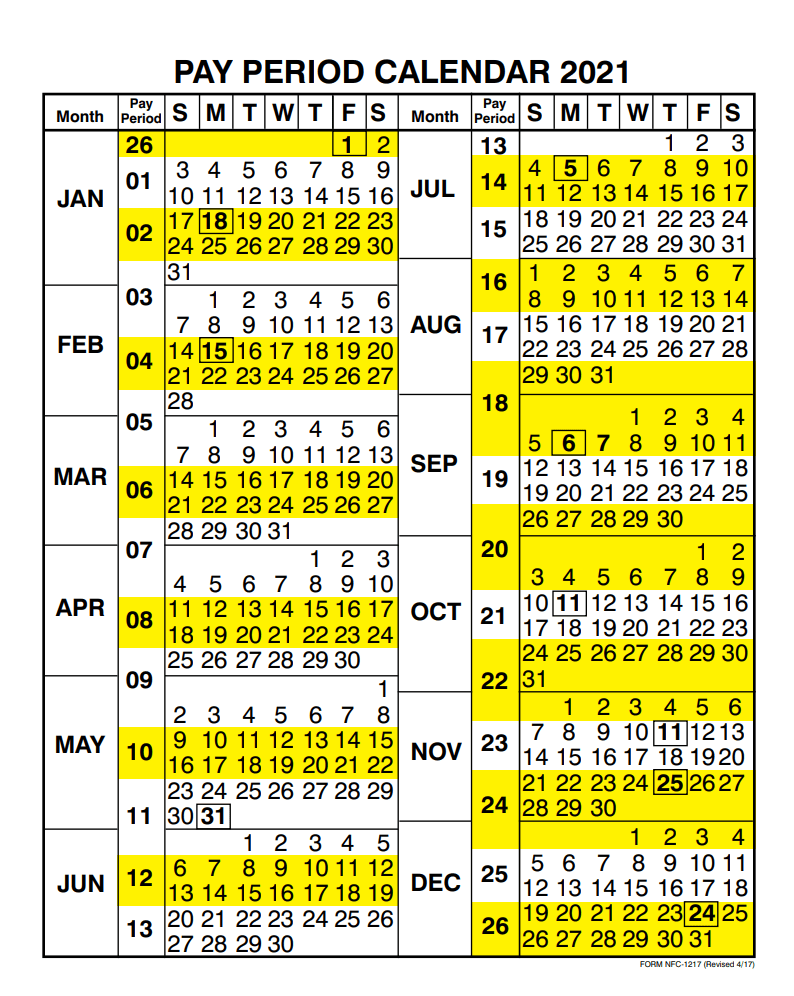

The 2025 payroll calendar outlines the specific dates for payroll processing throughout the year. It encompasses:

- Pay Periods: These are the intervals between payroll runs, typically bi-weekly, semi-monthly, or monthly.

- Pay Dates: These are the actual dates when employees receive their paychecks.

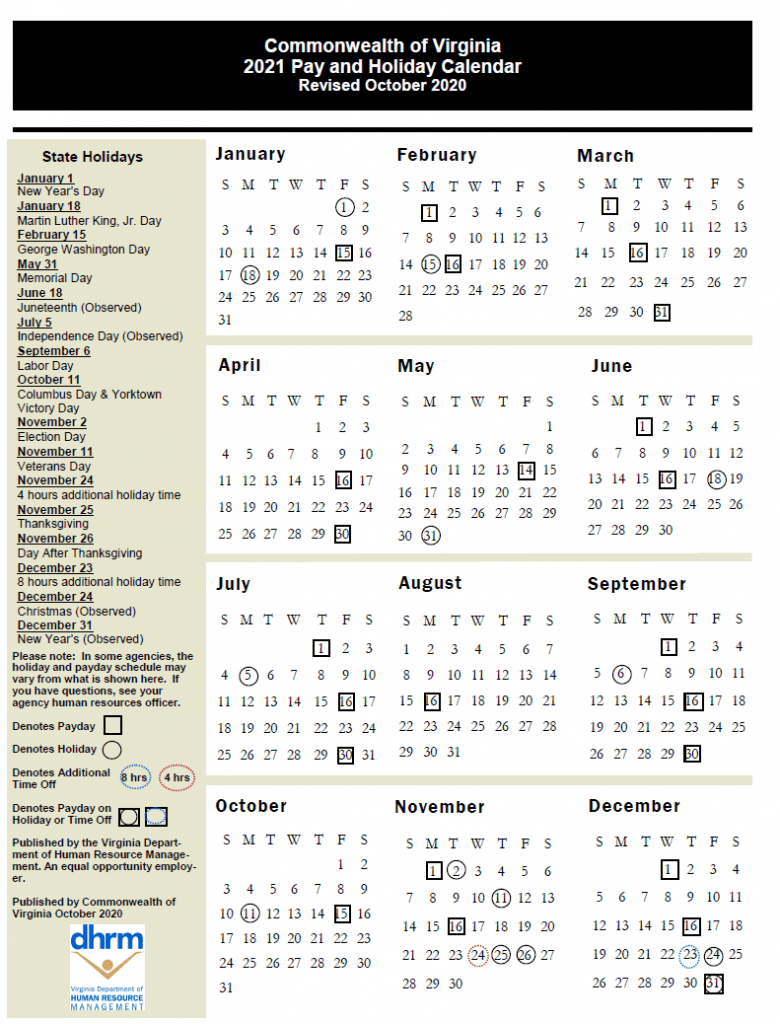

- Holidays: The calendar incorporates federal and state holidays, impacting pay dates and potentially affecting payroll processing.

Benefits of Utilizing the 2025 Payroll Calendar:

- Enhanced Financial Planning: By knowing the exact dates for payroll processing, businesses can accurately forecast their cash flow, ensuring sufficient funds are available for payroll obligations.

- Streamlined Payroll Operations: The calendar provides a clear roadmap for payroll departments, facilitating efficient processing and minimizing errors.

- Improved Employee Satisfaction: Employees appreciate the predictability of pay dates, contributing to a more stable and positive work environment.

- Compliance with Labor Laws: The calendar helps businesses adhere to relevant labor laws regarding minimum wage, overtime, and other payroll regulations.

Navigating the 2025 Payroll Calendar: Key Considerations

- Holiday Variations: Different states and organizations may have unique holiday schedules, necessitating careful review and adjustments to the calendar.

- Payroll Frequency: The chosen payroll frequency (bi-weekly, semi-monthly, etc.) significantly influences the calendar’s structure and pay dates.

- Calendar Updates: It is essential to remain informed of potential changes to the calendar due to legislative updates or unforeseen circumstances.

Utilizing the 2025 Payroll Calendar Effectively: Practical Tips

- Proactive Planning: Utilize the calendar to anticipate upcoming payroll dates and plan accordingly, ensuring timely payment of employee salaries and taxes.

- Communication is Key: Communicate the payroll calendar to employees, keeping them informed of pay dates and potential variations.

- Integration with Accounting Systems: Integrate the calendar with accounting software to automate payroll processing and improve accuracy.

- Regular Review: Periodically review the calendar for any updates or adjustments, ensuring its continued relevance and accuracy.

Frequently Asked Questions (FAQs) Regarding the 2025 Payroll Calendar:

1. What are the key differences between bi-weekly and semi-monthly pay periods?

Bi-weekly pay periods involve paying employees every two weeks, while semi-monthly pay periods involve paying employees twice a month, typically on the 15th and the last day of the month.

2. How do holidays affect payroll processing?

Holidays can shift pay dates. If a pay date falls on a holiday, it is typically moved to the next business day. The 2025 payroll calendar will reflect these adjustments.

3. What are some common payroll errors to avoid?

Common errors include incorrect deductions, missed pay dates, and inaccurate calculation of overtime. Utilizing the payroll calendar and implementing robust payroll processes helps minimize these risks.

4. Are there any resources available for accessing the 2025 payroll calendar?

Numerous resources are available online, including payroll software providers, government websites, and financial institutions.

5. Can I customize the 2025 payroll calendar to suit my specific needs?

Yes, you can customize the calendar to align with your organization’s unique payroll frequency, holiday schedule, and other relevant factors.

Conclusion: The 2025 Payroll Calendar: A Vital Tool for Financial Management

The 2025 payroll calendar is an indispensable tool for ensuring efficient and accurate payroll processing. By understanding its structure, benefits, and practical applications, businesses can optimize their financial management, enhance employee satisfaction, and maintain compliance with relevant labor laws. The calendar serves as a foundation for financial stability, facilitating proactive planning, streamlined operations, and a positive work environment.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Payroll Calendar: A Comprehensive Guide for Efficient Financial Management. We thank you for taking the time to read this article. See you in our next article!