Navigating Payroll in 2025: A Comprehensive Guide to ADP’s Calendar and Beyond

Related Articles: Navigating Payroll in 2025: A Comprehensive Guide to ADP’s Calendar and Beyond

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Payroll in 2025: A Comprehensive Guide to ADP’s Calendar and Beyond. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Payroll in 2025: A Comprehensive Guide to ADP’s Calendar and Beyond

The year 2025 is approaching, and with it comes the need for businesses to stay organized and compliant when it comes to payroll. ADP, a leading provider of payroll and human capital management solutions, offers a comprehensive calendar to help businesses navigate the complexities of payroll throughout the year. While a specific 2025 ADP payroll calendar is not yet publicly available, this guide will explore the key features and benefits of such a resource, providing a framework for understanding how ADP can support your payroll needs in the coming years.

Understanding the Importance of a Payroll Calendar

A payroll calendar serves as a vital tool for businesses of all sizes, particularly those with fluctuating pay cycles or complex payroll regulations. Its importance lies in its ability to:

- Promote Timely and Accurate Payroll Processing: A calendar clearly outlines payroll deadlines, ensuring that payroll is processed on time and that employees receive their compensation promptly. This minimizes the risk of late payments, penalties, and employee dissatisfaction.

- Facilitate Compliance with Labor Laws: Payroll regulations can vary significantly based on location, industry, and employee type. A comprehensive calendar incorporates these regulations, helping businesses adhere to legal requirements and avoid costly fines.

- Optimize Payroll Operations: By providing a centralized overview of payroll-related events, the calendar allows businesses to plan and manage their payroll processes efficiently. This includes scheduling payroll runs, processing tax payments, and managing employee benefits.

- Enhance Communication and Transparency: A well-structured calendar serves as a communication tool, allowing employees to be informed about payroll dates and any potential changes. This fosters transparency and builds trust between employers and employees.

ADP’s Role in Payroll Management

ADP, a global leader in human capital management, provides a suite of payroll solutions designed to simplify and streamline payroll processes. The company’s comprehensive platform encompasses:

- Payroll Processing: ADP’s technology automates payroll calculations, tax deductions, and payment processing, minimizing manual errors and ensuring accuracy.

- Time and Attendance Tracking: The platform integrates with time and attendance systems, allowing businesses to track employee hours worked and calculate pay based on accurate time records.

- Tax Compliance: ADP assists with tax filing and compliance, ensuring that businesses meet all federal, state, and local tax requirements.

- Employee Self-Service: ADP offers employee self-service portals, empowering employees to manage their payroll information, view pay stubs, and access other relevant data.

Key Features of an ADP Payroll Calendar

While a specific 2025 ADP payroll calendar is not yet available, the following features are typically included in ADP’s calendar offerings:

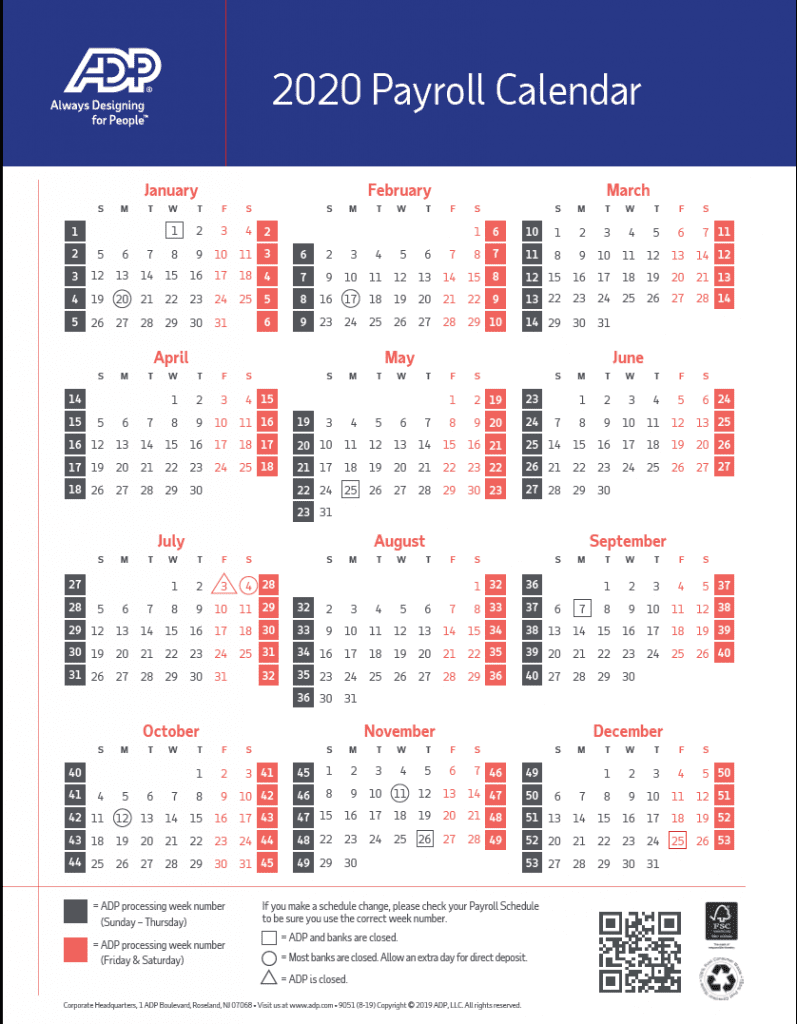

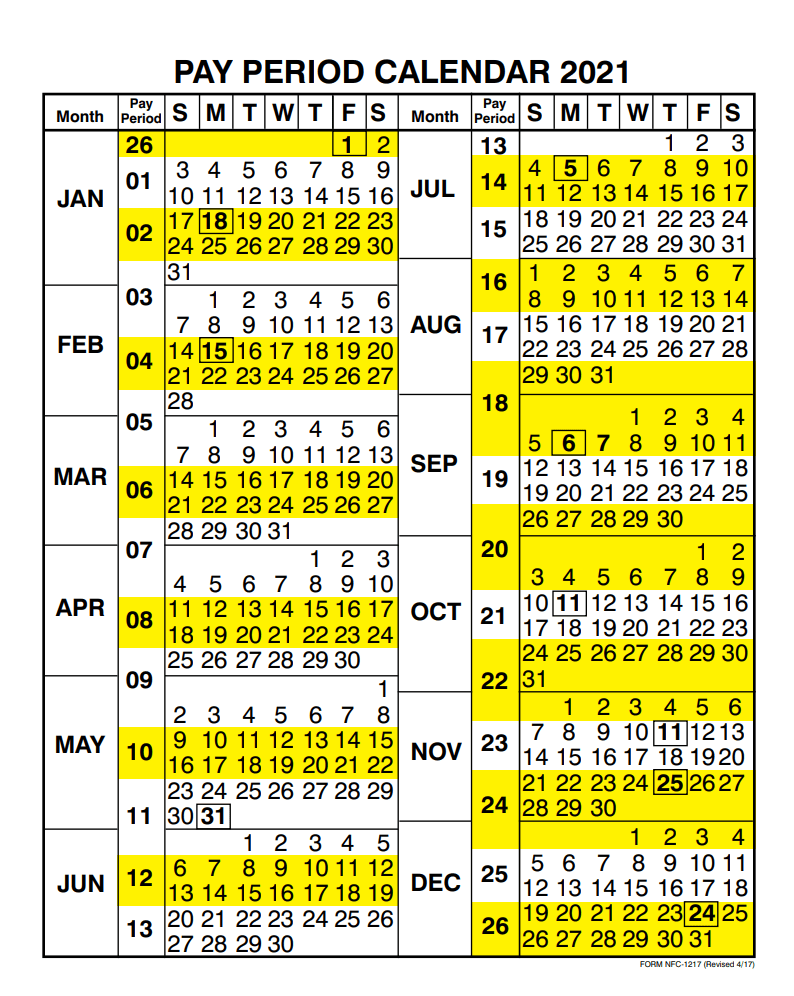

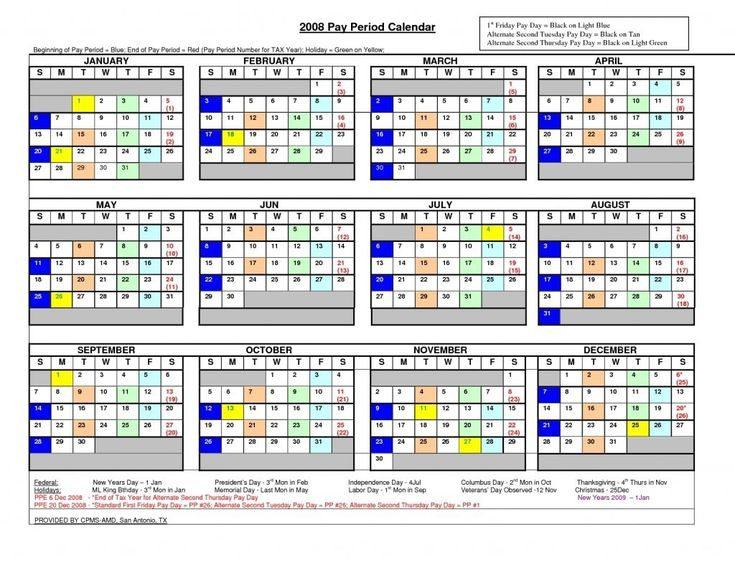

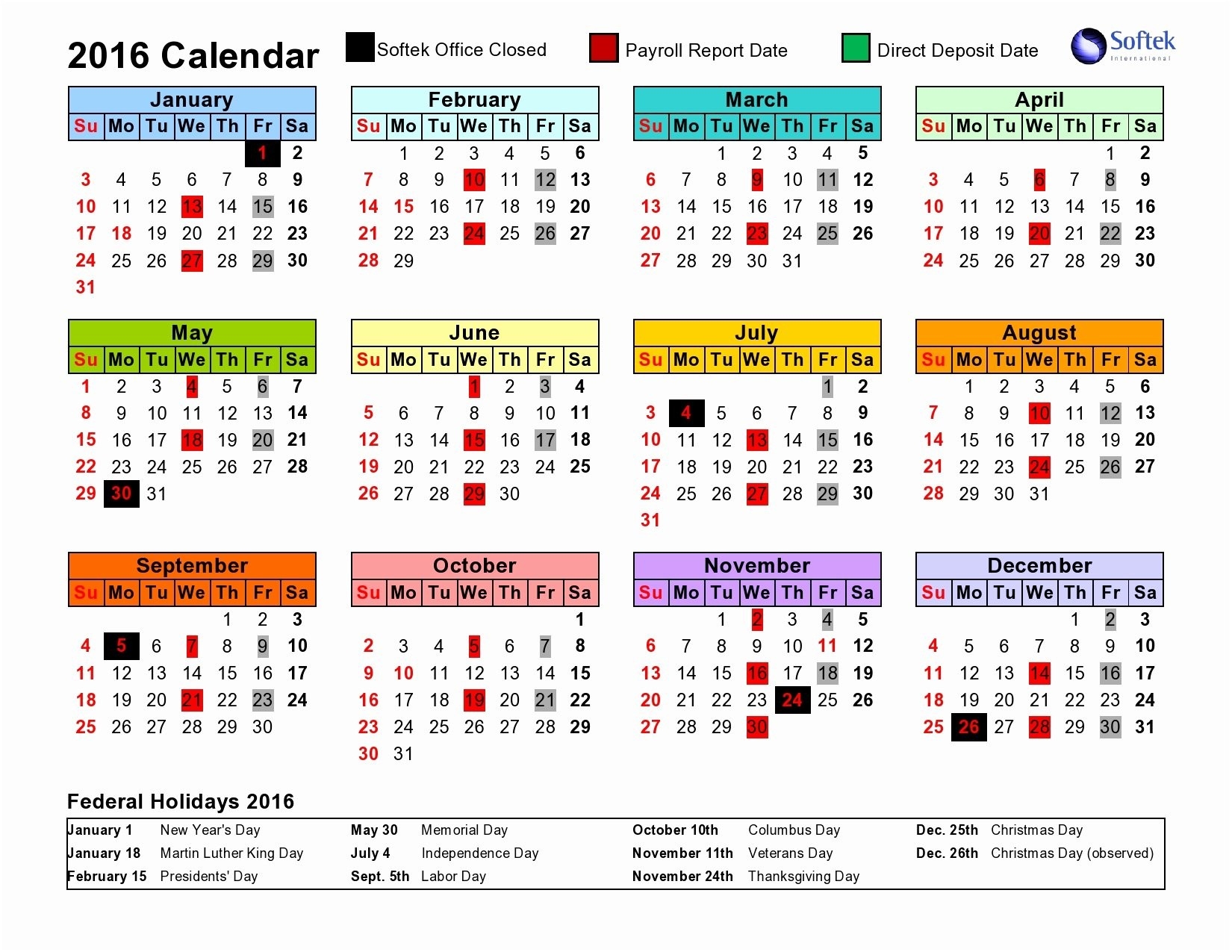

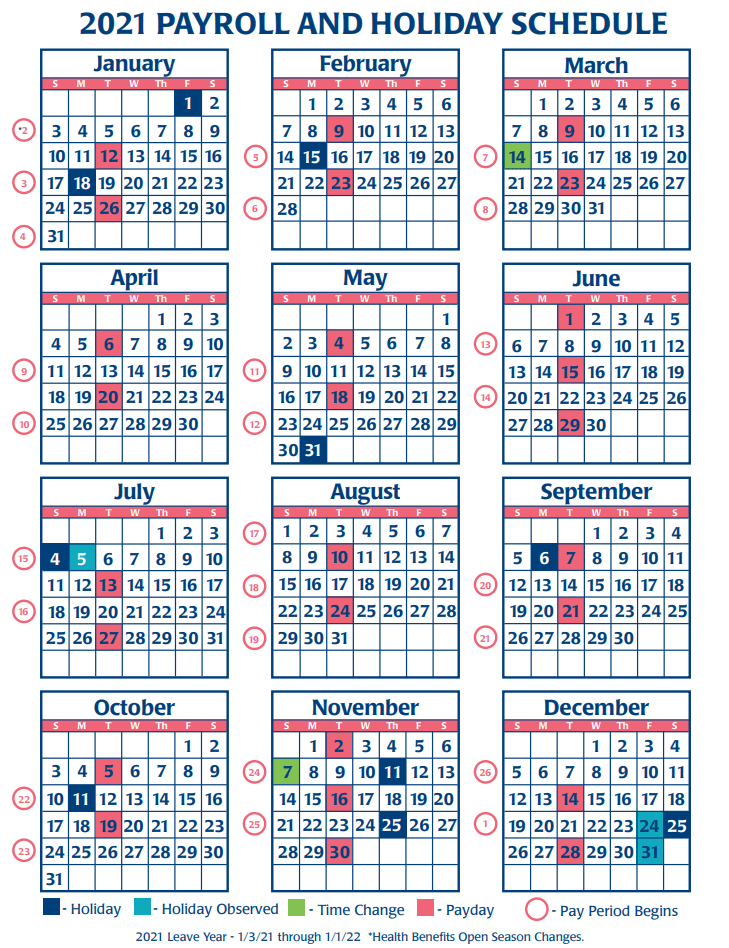

- Payroll Deadlines: The calendar highlights key payroll deadlines, including regular pay dates, tax filing deadlines, and other relevant dates.

- Tax Filing Requirements: It outlines tax filing obligations, such as federal, state, and local income tax withholdings, as well as payroll taxes.

- Employee Benefits: The calendar may include information about employee benefits, such as health insurance premiums, retirement contributions, and other deductions.

- Holiday Observances: It considers statutory holidays, providing information on payroll adjustments and potential changes in payment schedules.

- Legal Updates: The calendar is updated regularly to reflect any changes in payroll regulations or labor laws.

Benefits of Utilizing an ADP Payroll Calendar

Employing an ADP payroll calendar offers numerous benefits for businesses:

- Reduced Risk of Errors: The calendar helps businesses avoid payroll errors by providing clear guidance on deadlines, tax requirements, and other important details.

- Improved Efficiency: Automating payroll processes through ADP’s technology and utilizing the calendar streamlines operations, saving time and resources.

- Enhanced Compliance: The calendar ensures adherence to all relevant payroll regulations, minimizing the risk of fines and penalties.

- Improved Employee Satisfaction: Timely and accurate payroll processing contributes to employee satisfaction and morale.

- Better Financial Planning: The calendar helps businesses plan their financial resources effectively by providing a clear overview of payroll expenses.

Frequently Asked Questions (FAQs)

1. How do I access an ADP payroll calendar?

ADP clients can typically access the payroll calendar through their online portal or by contacting their ADP representative.

2. What if my business operates in multiple locations?

ADP’s calendar can be customized to reflect different payroll regulations based on location. It is crucial to ensure that your calendar incorporates all relevant state and local laws.

3. How often is the ADP payroll calendar updated?

ADP’s calendar is updated regularly to reflect any changes in payroll regulations, tax laws, or other relevant information. It is essential to stay informed about these updates and ensure your business is operating in compliance.

4. Can I use an ADP payroll calendar even if I don’t use ADP’s payroll services?

While ADP’s calendar is designed for its clients, other payroll providers or businesses can utilize the information provided as a general guide to understand payroll deadlines and regulations.

5. What if my business has unique payroll needs?

ADP offers customizable solutions tailored to specific business requirements. It is advisable to consult with an ADP representative to discuss your unique needs and ensure the calendar aligns with your specific payroll practices.

Tips for Effective Payroll Management in 2025

- Stay Informed: Regularly review and update your payroll calendar to reflect any changes in regulations or company policies.

- Automate Where Possible: Utilize ADP’s payroll technology to automate processes, minimizing manual errors and improving efficiency.

- Communicate Clearly: Keep employees informed about payroll dates, deductions, and any changes in payroll practices.

- Seek Expert Advice: Consult with an ADP representative or payroll specialist to address any specific questions or concerns.

- Plan Ahead: Use the calendar to plan for payroll expenses, tax payments, and other financial obligations.

Conclusion

Navigating the complexities of payroll in 2025 will require businesses to remain proactive and organized. ADP’s payroll calendar serves as a valuable resource, providing a comprehensive overview of payroll deadlines, tax requirements, and other critical information. By utilizing ADP’s solutions and embracing best practices, businesses can streamline their payroll processes, ensure compliance, and foster a positive employee experience. As the year 2025 approaches, businesses can leverage ADP’s resources to navigate payroll with confidence and efficiency, ensuring a smooth and compliant payroll experience for both employers and employees.

Closure

Thus, we hope this article has provided valuable insights into Navigating Payroll in 2025: A Comprehensive Guide to ADP’s Calendar and Beyond. We thank you for taking the time to read this article. See you in our next article!